This article was originally posted in The Guardian

By Subomi Plumptre

March 24, 2023

It’s 9pm on a Monday evening, and Tunde is desperately looking for cash in Lagos, Nigeria. After queuing for 3 hours at a bank ATM, he approaches a local Point-of-Sale (PoS) agent who charges him N1,500 to withdraw N10,000. He accepts the unfair price with a mix of anger and resignation. He has no cash to get to work the next day and public buses do not accept electronic payments. Tunde’s struggle exemplifies the current fate of everyday Nigerians due to the Central Bank of Nigeria’s recent cash policies.

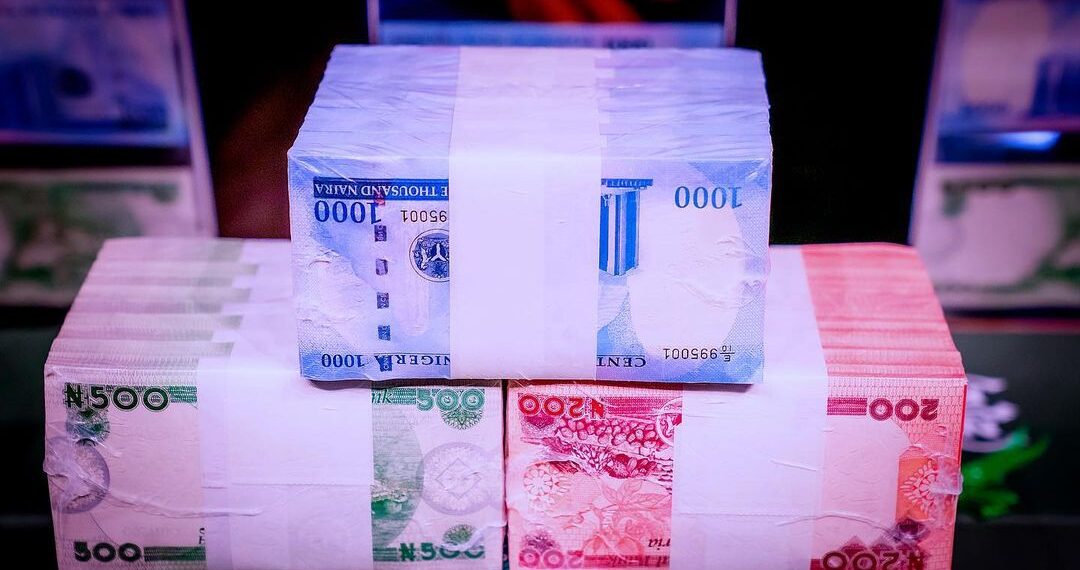

The currency redesign and cash withdrawal limits of the Central Bank of Nigeria (CBN) sparked economic turmoil and some outrage across the country ahead of a general election. The policies, which included the introduction of new N200, N500, and N1,000 banknotes and the phasing out of the old notes, aimed to tackle corruption and facilitate the country’s transition to a cashless economy. However, the immediate result was a scarcity of Naira, a black market for old and new notes, and PoS operators charging exorbitant fees for cash withdrawals.

A Deputy Governor of the CBN admitted that he did not anticipate the unexpected effects – more specifically, entrepreneurial human behaviour. People created new business lines such as going to ATMs with multiple cards (from family and friends) to withdraw cash for sale. According to the National Bureau of Statistics (NBS), inflation was at a 17-year high, rising by 21.82% in January, amid the deadline for phasing out old notes. Coupled with Nigeria’s epileptic power supply and escalating petrol prices, the scarcity of Naira transformed the country into a steaming hotbed of citizen frustration and agitation, ahead of the general elections.

Court Hearings and Contempt Charges

In February, some state governors dragged the Federal Government to the Supreme Court and on the 8th, the court issued an interim order, restraining the CBN from enforcing the February 10th deadline for the phasing out of the old Naira. The government largely ignored the order except for allowing only the lower N200 denomination to be used by Nigerians for another 60 days until April 2023.

The courts fixed a follow up hearing for February 22 (by which time there were sixteen plaintiffs), and the hearing was adjourned until March 3rd, a week after the Presidential elections. At the hearing, the apex court ruled that the old N200, N500, & 1000 notes should remain legal tender until December 31st. But people allegedly rejected the old notes due to a lack of confirmation from the CBN.

On the 11th of March, ten states filed contempt charges against the Federal Government and the CBN for non-compliance with the court order. Two days later, the CBN directed Nigerians to go back to using the old notes along with the new ones, barely five months after it announced the Naira redesign policy and all its intended benefits.

The Indian Comparison and Unintended Consequences

They say the road to hell is paved with good intentions; but most Nigerians would say that the good intentions of the CBN’s policies only succeeded in paving the way to hell-on-earth for them.

The policies have hit the middle class and unbanked particularly hard. The cash crunch and disruption in banking services also affected small and medium-scale enterprises, which are mostly owned by middle and lower-class Nigerians. In a bid to withdraw cash, citizens reportedly vandalized banks in some states. According to Oluwole Olusoji, president of the Association of Senior Staff of Banks, Insurance and Financial Institutions (ASSBIFI), up to N5 billion may have been lost by banks due to attacks on their facilities in different parts of the country.

The situation in Nigeria drew comparisons to India’s attempt at a similar policy in 2016. Indian Prime Minister Narendra Modi’s sudden withdrawal of the highest denomination currency led to suffering for people without access to debit cards or mobile money. The Nigerian government’s decision was less sudden than that of India, which happened overnight. The CBN gave a 90-day notice and a further 10-day extension. But the result was the same for a nation of 200 million people, about 55% of whom are unbanked, according to the World Bank – sheer chaos and suffering.

To be fair, the CBN’s policies have had some unintended positive consequences. Nigerians are becoming more open to cashless transactions. However, now that the dust is settling, there are retrospective lessons we can learn, particularly in the areas of policy implementation and stakeholder management. I will highlight some of them.

Nigerians Can Adapt to Change, But They Shouldn’t be Taken for Granted by Government.

One big effect of the CBN’s policies is that more Nigerians are adapting to digital payments, including those who were otherwise averse to doing so, such as roadside vendors and market people. This shift is reflected in the rise in Point of Sales transactions, which hit N807.16bn in January 2023, representing a 40.69% year-on-year increase compared to January 2022, according to Nigeria Inter-Bank Settlement System (NIBBS). But there are complaints about the exorbitant transaction charges that come with digital payments during a cash crunch.

The CBN Could do Better With Policy Communication.

Nigeria’s apex bank still has problems with policy communication, stakeholder engagement, and implementation. In recent times, the bank has had to make a series of explanations, clarifications, extensions, and modifications after-the-fact.

A text-mining analysis of the CBN’s communication published in the CBN Journal of Applied Statistics states that, “While the institution’s communication has increased substantially over the years, the word and sentence structures of the policy communique have become more complex, reducing its readability.” (Tamala and Omotosho, 2019)

The Infrastructure for Digital Banking Needs to be Scaled by Regulators.

To support the cashless economy, the infrastructure for digital banking needs to be scaled by regulators. Failed transactions on mobile banking apps were on the rise during the cash crunch. While most customers suppose the transaction issues to be a problem with their banks, there are suggestions that some of the problems are more fundamental, such as the infrastructure of the Nigerian Inter-Bank Settlement System (NIBSS) that supports transactions between banks.

Access to Banking Services Remains Abysmally Low.

Financial services penetration is quite low in Nigeria. In a 2019 EFInA study examining access to financial services, it was stated that in rural areas, up to 42 million Nigerian adults lack banking services. The study further found that there are no bank branches, agents, or ATMs in over 60% of rural communities. While mobile money has helped bridge the financial gap, it is still far from a common option and in the study, only 4% of adults have accounts.

Government Should Integrate Social Safety Nets into Policies with a High Impact on the Masses.

According to EFInA, about 63% of the population, or about 133 million people, currently live in multidimensional poverty. Of this number, about 79.7% live in rural areas with poor access to banking services. While the government continues to tout the benefits of a cashless policy per its ability to target corrupt looters and vote buyers, there seems to be no clear effort to address the possible negative impact on the masses.

Parallel Markets Have a Strong Influence on Cash Systems.

While the term “parallel markets” in the Nigerian context mostly refers to the black market for foreign exchange, it now includes a market for newer (cleaner) currency notes, mostly driven by a culture of spraying money at social events. These parallel markets have a strong influence on the banking system and are likely to have contributed to the Naira scarcity, as funds were mopped up by middlemen to sell for a profit.

Nigerians Remain Resilient but Might be Reaching a Breaking Point.

Resilience can be inferred from how the unbanked adapted to the scarcity of the Naira. There were reports of trade-by-barter among some rural dwellers while others at the border, traded in CFA francs.

However, it appears that for a time, Nigerians were faced with a perfect storm of the after-effects of the Covid-19 lockdown, increased unemployment, petrol shortages, epileptic power supply, cash scarcity and then political tensions during elections. Will resilience alone see them through? Only time will tell.

Subomi Plumptre is the CEO of Volition Cap, an SEC-licensed asset management firm working to bring financial prosperity to middle class Africans and Diasporans.