Volition Capital Investments Limited (Volition Cap), a SEC-licensed asset management company empowering the middle-class to create wealth, in collaboration with Opportunik, a private wealth fund giving Africans and Diasporans access to global investments, today published a transformative white paper. The white paper sets out a comprehensive approach to wealth creation for middle-class Africans and their counterparts living abroad.

There are stark wealth gaps between middle-class and mass affluent Africans and between individuals of Black ethnicities (Diasporans) and other groups. To bridge these disparities, the white paper emphasizes the crucial need for Africans and Diasporans to build wealth at a rate that is 7 to 10 times faster than their counterparts.

Key Findings

Among the white paper’s significant findings is that aggregating local & diaspora funds in a collective investment pool can create significantly higher returns for African middle-class and diasporan investors. In a survey of 3,000 members of an African cooperative over a four-year period, about 45% of members had attained a financial independence rate of between 25%- 100%.

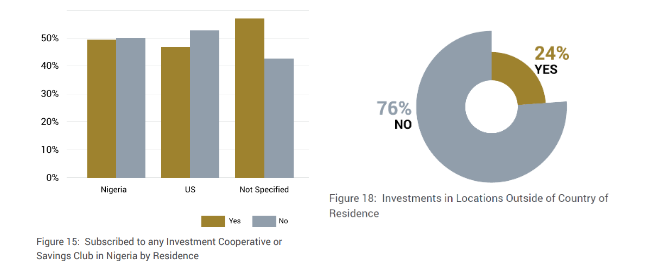

Another interesting statistic is that 54% of Nigeria’s middle class at home and in the US, are leveraging cooperatives and savings clubs in Nigeria to enhance their income and to attain financial independence. However, only about 24% are taking advantage of other global investments.

The Way Forward

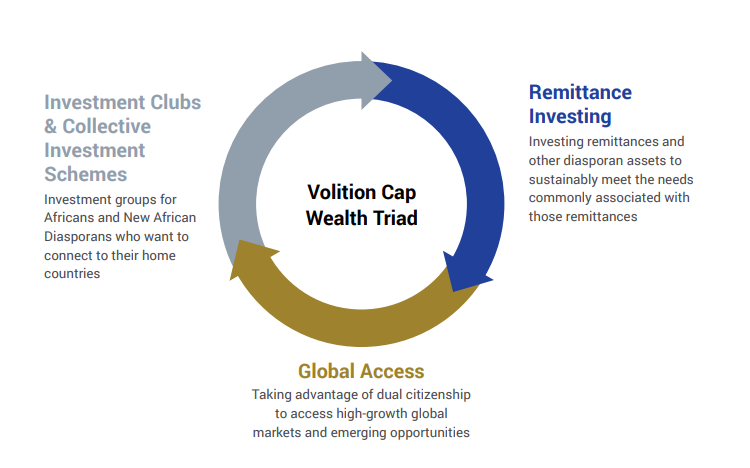

The white paper introduces the “Volition Cap Wealth Triad” comprising Cooperatives, Global Access and Remittance Investing. This triad provides a dynamic approach to resolving the pressing need for high growth to close wealth gaps, while also addressing the consumption needs of dependents in Africa through remittances.

Subomi Plumptre, CEO of Volition Cap, said that, “This white paper serves as a roadmap for leveraging local cooperatives and cross-border investing to bridge wealth gaps and to provide opportunities for long-term prosperity.”

Kola Oyeneyin, CEO of Opportunik, added, “Our collaboration has resulted in a comprehensive white paper that showcases the immense potential for wealth creation among middle-class Africans and Diasporans. By harnessing the power of remittances and implementing global investments, we can pave the way for a brighter financial future for this demographic.”

The companies’ research methodology involved meticulous analysis of various sources, including user surveys, academic desk sources, country case studies, statistical reports, news articles, expert interviews and pilot investment programs.

For further details on the research and to access the full white paper, visit www.volitioncap.com/whitepaper.

About Volition Cap

Volition Cap is a SEC-licensed and game-changing asset manager that empowers Africans and Diasporans to create wealth. Since 2018, the company has been at the forefront of investments for individuals and support for businesses.

Through strategic partnerships, Volition Cap created a $30 million private equity fund for agriculture and real estate projects in Africa. It pioneered the first fund that leveraged traditional cooperatives, which led to 3,000 members achieving a financial independence rate of up to 75% within three years. Volition Cap also disbursed $250,000 to African filmmakers through its landmark entertainment and media fund.

With a mission to drive economic independence, Volition Cap’s financial literacy courses have equipped over 10,000 Africans to take control of their finances.

About Opportunik Global Fund

Opportunik believes nothing should hold back the hardworking from achieving their financial dreams; this is why they created Opportunik Global Fund (OGF) – a focused private wealth fund designed by Africans for Africans. OGF provides USD investments to middle-class and mass-affluent Africans and Diasporans.

Opportunik carefully selects assets and maintains a dedicated team to deliver healthy returns. The fund is administered by Accuvise, a registered fund administrator with over $216 million in assets, ensuring OGF’s investors face minimal currency or political risks.

For More Read A Pan-African Perspective on Strategic Wealth Creation